Trump runs to remodel the days of the Fed days before the interest rate decision

Twelve political leaders of the Federal Reserve will take a high -risk vote this week on the reference interest rate of the Nation, trying to direct the economy through a stormy combat of slow hiring and growing inflation.

However, in a very unusual circumstance, two of the policy formulators are in Limbo, uncertain if they will vote at all, with just over 48 hours before the announcement.

In recent weeks, President Donald Trump moved to say goodbye to a member of the Board of Governors of the Fed and ensure confirmation of the Senate for another. The race to remodel to the Fed occurs after Trump criticized months against the Central Bank and its president Jerome Powell for rejecting attention to his call to lower interest rates.

The clash on the composition of the Fed Board issues uncertainty about the FED meeting on Wednesday, where officials are expected to announce the cut of the first rate of the Central Bank since December.

In a publication on social networks on Monday, Trump reiterated his criticism to Powell, saying that the president of the FED “must reduce interest rates, now, and larger than he had in mind.”

Recently, Trump moved to the member of the Fire Board, Lisa Cook, who sued Trump for her attempt to expulsion, saying that the decision violated her legal protections as an employee of the independent federal agency. Trump said he eliminated Cook for accusations of mortgage fraud against him.

The Federal Law allows the President to eliminate a member of the Fed Board “for Cause”, although no president has tried such elimination in the 112 years of history of the Central Bank.

Last week, a federal judge issued a preliminary court order that required that the Fed allows Cook to continue serving in his role as governor of the Federal Reserve system as his lawsuit moves through the courts.

Days later, the Trump administration filed an application before an appeals court asking to withdraw Cook on Monday, before the programmed vote on interest rates. In a judicial presentation during the weekend, Cook asked the Court of Appeals to reject Trump’s offer.

Last month, Trump asked Cook to resign the same day that Bill Abute, the director of the Federal Housing Finance Agency, published in part of a letter of August 15 sent to the United States Attorney General Pam Bondi accusing Cook of falsifying bank documents and properties records to acquire more favorable loan terms, “potentially committing mortuvios, the established letter.”

In a statement provided to ABC News at that time, Cook said he learned of the media about the pulte letter in search of a criminal reference on the mortgage application, which preceded his time with the Federal Reserve.

“I have no intention of being intimidated to give up my position due to some questions raised in a tweet,” Cook said in the statement last week. “I intend to take any question about my financial history as a member of the Federal Reserve, so I am collecting the precise information to answer any legitimate question and provide the facts.”

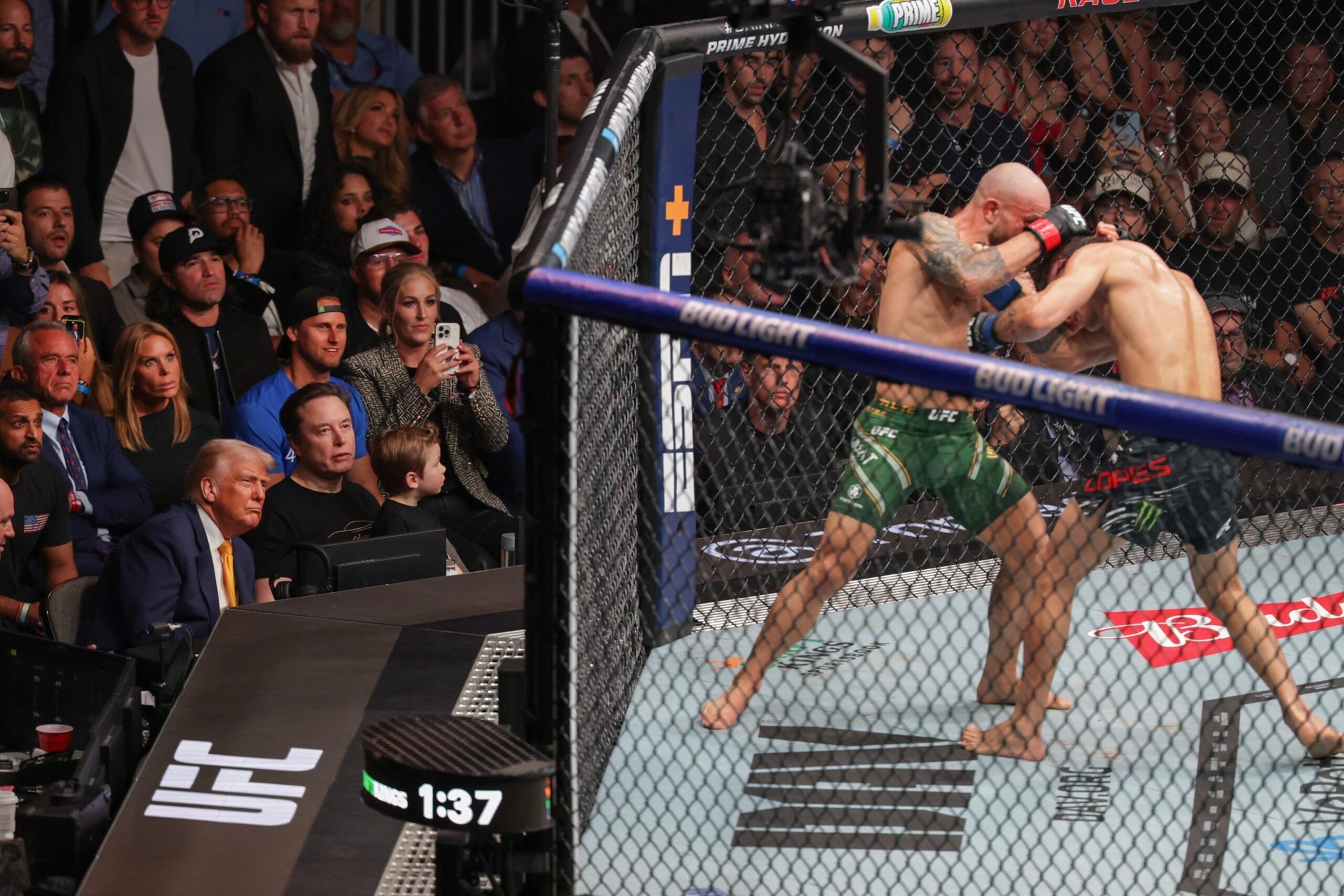

President Donald Trump and the president of the Federal Reserve, Jerome Powell, travel the renewal project of the headquarters of $ 2.5 billion of the Federal Reserve, July 24, 2025 in Washington, DC

Somodevilla/Getty chip

The Senate voted 48-47 on Monday night to confirm the nomination of the economic advisor of the White House Stephen look to serve as a member of the Board of Governors of the Federal Reserve.

Miran has promised to safeguard the independence of the Central Bank, but said earlier this month that it does not plan to give up its position within the Trump administration. Look is filling a vacancy created by the early retirement of the member of the Fed Board, Adrianna Kugler, whose term would end in January.

Miran said he plans to take an unpaid absence permit of his current role. Miran made the decision after “lawyer advice”, since his mandate at the Fed Board would last four months, they said at a Senate hearing this month.

Five meetings and nine months have passed since the last time the Fed adjusted interest rates. The federal fund rate represents between 4.25% and 4.5%, preserving much of a strong increase imposed in response to an episode of inflation of the pandemic era.

However, this position is expected to change. Powell recently hinted at the possibility of an interest rate cut, which seemed to indicate a greater concern to mark the growth of employment than the increase in prices.

Investors set the possibilities of a reduction in the rate of a quarter quarter to 96%, according to the CME Fedwatch toolA measure of the feeling of the market.