The Republican Party of the House of Representatives of $ 880 billion in Medicaid cuts despite internal differences

Republicans of the House of Representatives will advance on Tuesday to advance in the key components of their bill to finance the agenda of President Donald Trump, including taxes and clippings of Medicaid, even when they disagree with several critical issues.

The Energy and Commerce Committee of the House of Representatives, which has jurisdiction on energy and medical care programs, and the Chamber Media and Media Committee, which has jurisdiction over taxes, will have marathon brands in the hope of moving legislation to the floor.

The movement in the critical pieces of the “big and beautiful ticket” occurs when the speaker Mike Johnson faces the resistance of the different wings of his caucus with only three votes left over in his sharp majority.

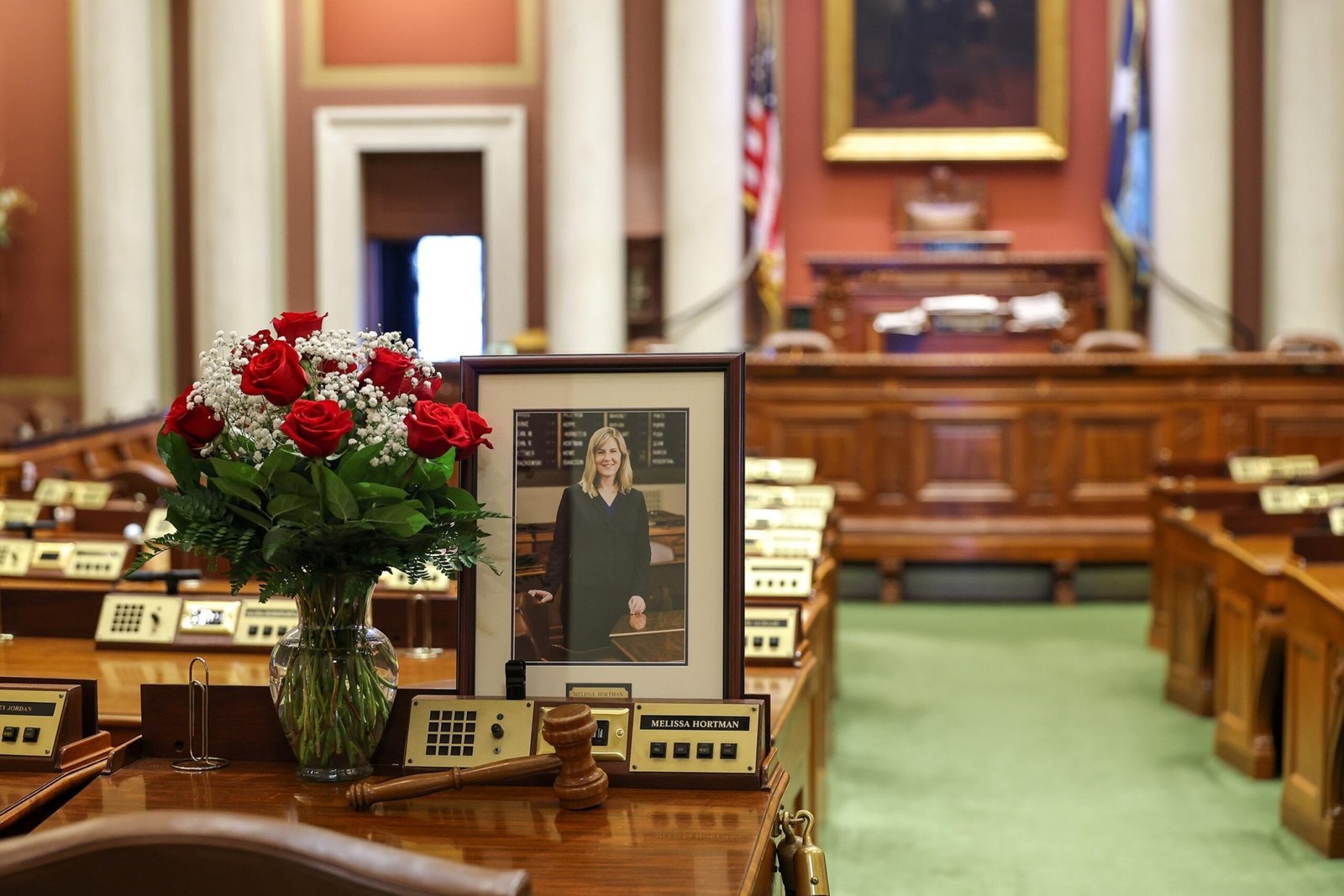

Texas’s republican representative, Chip Roy, said Monday that he opposes proposals and needs “significant” changes to support the final package.

The representative Chip Roy speaks with the media after the House of Representatives could not approve a draft Government Financing Law in the United States Capitol on December 19, 2024 in Washington.

Kevin Dietsch/Getty Images

“I remain openly because progress has been made depending on our forceful efforts to force change. But we cannot continue along the path we have been going down, and we will need significant additional changes to obtain my support,” he said in an X publication.

Trump repeatedly promised in the campaign and in the White House not to cut Medicaid and he and the Republicans said they will find savings by reducing waste and fraud in the program.

Before leaving on a four -day trip to the Middle East on Monday, he urged the Republicans to “unify” around the bill and said that the executive order that signed on Monday that “would reduce the cost of prescription drugs” and “hundreds of billions of tariff money” should be taken into account the score of the bill.

With Republicans in control of both Congress cameras, they are using a process called reconciliation that only requires a simple majority for the step to accelerate its legislation.

Republicans announced the legislative text during the weekend that described their plans to reduce Medicaid’s spending by imposing work requirements for recipients, carrying out more frequent eligibility controls and penalizing states such as New York and California that offer medicality to illegal immigrants.

The Congress Budget Office wrote in a letter to the President of Energy and Commerce, Brett Guthrie, which the proposal met its high objective for $ 880 billion of savings during the next decade.

The Energy and Commerce Committee resisted the pressure of uncompromising as Roy, which demanded that Republican leaders propose to reduce the percentage that the federal government pays to the medical programs of the states or includes per capita limits in federal payments of Medicaid to the states.

Health portions would save around $ 715 billion, according to CBO. However, at least 8.6 million Americans do not sure.

Some cultural war problems were addressed in the bill, including a provision to eliminate Medicaid funds from organizations that offer abortion services such as Planned Parenthood.

The legislation has already received the rejection of the Republicans in the Senate who will have to accompany it, including the Missouri senator, Josh Hawley, who wrote an opinion article in the New York Times, warning Monday against Moves to Cut Medicaid.

The president of the representative representative, Mike Johnson, arrives for a meeting of the Chamber’s Republican Conference at the United States Capitol, on May 6, 2025 in Washington.

Andrew Harnik/Getty Images

“This wing of the party wants Republicans to build our great and beautiful bill around health insurance for poor workers. But that argument is morally incorrectly and politically suicide,” Senator Hawley wrote.

Meanwhile, the Media and Media Committee, which is marking the tax part of the bill, described a permanent extension of the tax cuts and the 2017 Trump Labor Law, in addition to complying with the promises of its campaign as non -taxes on tips and without taxes on overtime.

The plan would temporarily increase children’s tax credit, create a magic savings account for children and temporarily increase the standard fiscal deduction. It also requires an increase of $ 4 billion to the debt roof, which Congress must address in mid -July to avoid breach.

The legislation also includes one of the most controversial components: a tax proposal that would increase the limit of state and local fiscal deductions (salt) from $ 10,000 to $ 30,000 for those who earn less than $ 400,000, that some moderate Republicans of the states with the highest taxes say it is not enough.

New York representative Nick Lalota said “it is still a hell not” in an X publication.

Representative Mike Lawler in New York told Bloomberg TV that the proposal was “unfortunately inadequate,” and added that he will vote against the bill if it is the floor.

“We will continue working in good faith with leadership, with the administration to do so, but we need to have an honest and serious discussion on the subject,” he added.

This is what is in the bill:

Medicaid cuts

Medicaid work requirements: The bill would impose the work requirements for the recipients of Medicaid with body, at least 80 hours per month, or would require registering in an educational program for at least 80 hours or some combination per month.

Most frequent eligibility verifications: The legislation would require states to make more frequent eligibility determinations, from every 12 months to every six months.

It prohibits Medicaid funds for gender transition for minors: The measure would prohibit federal medical funds from going to the attention affirmed by the genre for transgender minors.

Block Medicaid financing for non -citizens: The federal funds would be blocked to go to the states that provide under Medicare medical care coverage for migrants in the country without authorization.

It is aimed at Medicaid funds for organizations that provide abortions: The measure includes a language that would essentially prohibit medical care suppliers that offer abortion services to receive medicaid funds.

Drug price: The bill makes a change in the inflation reduction law and allows medications to be exempt from the negotiation of the price of Medicare medications if they are approved to treat multiple diseases.

Cut the energy programs in the Inflation Reduction Law: The proposal would reduce the programs of the Inflation Reduction Law as expenses in electric vehicles, federal funds related to the collection climate and eliminate the elimination of clean energy loans.

Tax provisions

No taxes on advice: A large tax exemption for the service industry and a provision that was also announced by Kamala Harris as the Democratic nominee for president, although it linked tax exemption to an increase for the federal minimum wage. This is temporary and would expire at the end of 2028.

No taxes on extra hours: It would relieve millions of Americans who work overtime. This is temporary and would also expire at the end of 2028.

Extension of the tax cuts of 2017 and the Labor Law: He makes taxes for permanent tax and 2017 jobs law; Does not include a richest winning taxes. Trump published last week that the proposal should not increase taxes to senior winners, “but I’m fine if they do!”

Creation of the Maga Savings account for children: The contribution limit for any taxable year is $ 5,000. Includes a pilot program to start the accounts with $ 1,000.

SALT: Raise the state and local tax deduction limit to $ 30,000 with an income per phase of $ 400,000 above $ 400,000. Married couples that have separate taxes are subject to a $ 15,000 limit and an income above $ 200,000 above $ 200,000.

Increased debt limit: The measure requires increasing the debt limit by $ 4 billion. The secretary of the Treasury, Scott Besent, said that the legislators of last week must address the debt limit in mid -July to avoid breach.

Improved Fiscal Deduction for older people: Older people would obtain a higher standard fiscal deduction of $ 4,000 subject to income limits. This is temporary and would also expire at the end of 2028.

Hikes special taxes in universities: Those with endowments of more than $ 2 million per student would increase from 1.4% to 21%, aimed at the Ivy League schools. Religious schools would be exempt.

Fiscal Credit of the Children: A temporary increase of $ 1,000 to $ 2,500 to 2028 and $ 2,000 after that. The recipients will be required to have a social security number.

Deduction for qualified businesses: The bill would increase the deduction for commercial income qualified from 20% to 22%.

It extends a greater tax exemption on assets and donations: The tax exemption on assets and donations to $ 15 million would increase.

Raises standard fiscal deduction: The measure includes some new tax cuts, such as temporarily elevating the standard deduction at $ 2,000 to $ 32,000 by 2025 for joint filingers and at $ 1,000 to $ 16,000 to 2028.